CTV’s ad spend jumped 16% last year, a significant rebound from 2023, when it lagged behind online and social video, according to The IAB Digital Video Ad Spend and Strategy Report released today.

CTV’s resurgence marks a pivotal moment as digital video has become the dominant force in the TV/video market.

CTV is expected to grow another 13% in 2025 to reach $26.6 billion. That will put CTV firmly ahead of online video, with CTV ad spend in 2025 projected to be 43% larger than online video ($18.6 billion).

One critical force behind the increase is streaming platforms’ improved programmatic and self-serve activation tools. These advancements have made investing their ad dollars significantly easier for brands of all sizes.

This ease of activation, combined with CTV’s targeting and measurement capabilities, make it the channel of choice in advertisers’ minds. Over two-thirds (68%) of advertisers said CTV is essential for their media plans, placing it at the top of the “must buy” list, with social video close behind at 62%.

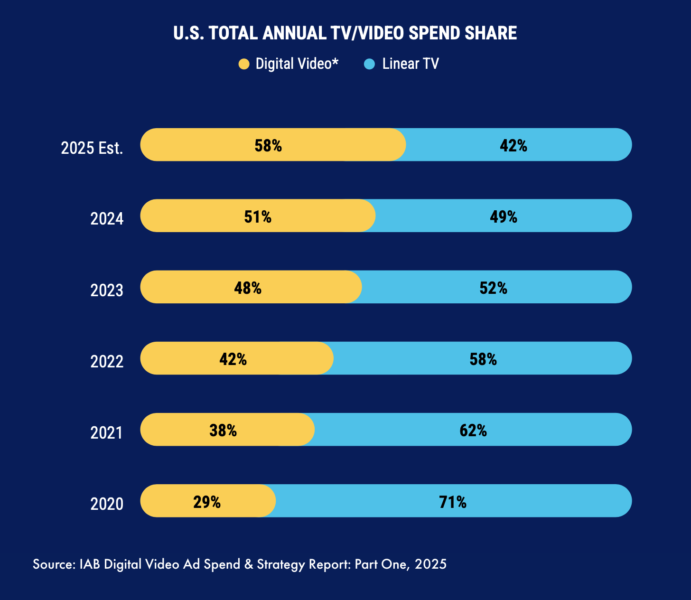

Digital video solidifies dominance, pulling ahead of linear TV

CTV’s resurgence is part of a broader increase in all digital video advertising. Digital video — CTV, social video and online video — grew 18% in 2024 and is projected to grow another 14% in 2025, reaching $72 billion. That is two to three times faster than total media overall.

By the end of the year, digital video ad spending is expected to be nearly 60% of total TV/video ad spend, more than doubling its share over the past five years. Only last year, digital video advertising surpassed linear TV for the first time. The gap will likely increase in 2025, partly because linear TV won’t have the ad spend boost of presidential elections or the Olympics.

Where is the money coming from?

The money flowing into CTV primarily comes from reallocations. The top sources of these funds (each cited by an equal percentage of those increasing CTV spend) are:

- Linear TV (36%).

- Social media (36%).

- Online video (excluding YouTube, 34%).

- Paid search (32%).

- Digital display (31%).

The reallocation from search and display highlights marketers prioritizing CTV’s targeting and reach capabilities.

Dig deeper: How to make CTV ads that stick

Key growth categories and emerging strategies

While most categories are projecting double-digit growth in digital video in 2025, CPG, retail and pharma are projected to be the biggest users.

These categories are leveraging digital video for specific strategic advantages:

- CPG brands’ spending is fueled by retail media networks and retail media data, a strategic push to diversify their video presence beyond social and online video, and the expansion of broadcasters’ CTV offerings.

- Retail, auto and restaurant brands are focusing on real-time, location-based messaging and integrating shoppable ad formats.

- Pharma brands are increasingly using AI and data to personalize messaging, aligning with broader trends in CTV and social video. Notably, CTV is shown to drive high ad engagement rates for pharmaceutical ads.

Market dynamics and methodology

As with all recent surveys about marketing, this one comes with a big and reasonable asterisk: “Due to ongoing economic uncertainty, including tariffs, geopolitical conflict and changing consumer sentiment, this year’s market is more dynamic than normal.”

The report is based on 364 surveys February 17 and March 7. Respondents were verified as industry leaders who are involved in recommending, specifying, or approving advertising spending in digital video, spent at least $1 million on advertising in 2024 and work at agencies or directly for a brand marketer. It is available to IAB members.

The post CTV ad spend jumps 16% as digital video becomes dominant force in TV/video market appeared first on MarTech.