The IAB’s 2024 Internet Ad Revenue Report is a snapshot of a more settled time and a guide for the rocky road ahead. Current trends in marketing have the industry well-positioned for a rough economy.

Digital advertising continues to thrive, reaching a record $258.6 billion in revenue. That’s a healthy 14.9% year-over-year increase from 2023 and the most substantial gains since 2021.

“This record growth reflects the industry’s ability to adapt to evolving technologies, regulatory changes and shifting consumer behaviors,” the report states. “Yet, amid global uncertainty and a dynamic macroeconomic environment, the industry must remain agile and focused as external factors could influence the pace and shape of future growth.”

Here’s a look at the main channels and developments in the report.

Digital video grabs center stage

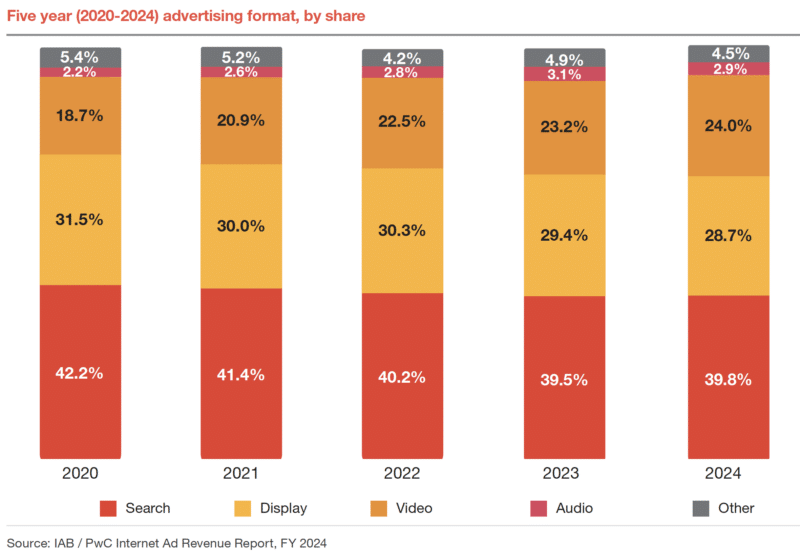

Digital video, now the fastest-growing format, saw a remarkable 19.2% YoY increase, bringing in $62.1 billion and accounting for 24% of total ad revenue. Search and Display revenues increased $14.1 billion to $102.9 billion, a 15.9% annual growth and three times the 5.2% growth in 2023.

Search still dominant

Despite the rapid growth of video, search advertising remains the largest segment, reaching $102.9 billion with a 15.9% YoY growth, maintaining its leading 39.8% market share. The revenue growth is three times that of 2023.

Social media roars back

After slower growth in 2023, social media ad revenue rebounded with a substantial 36.7% YoY growth in 2024, reaching $88.8 billion. This $23.8 billion increase showed a renewed advertiser confidence in social platforms, election spending and the popularity of commerce and creator collaborations.

Retail media continues its remarkable growth

Retail media network advertising revenues rose 23% year over year to reach $53.7 billion in 2024. The $10.1 billion increase shows the increasing importance of first-party data ecosystems and closed-loop reporting as brands adapt to privacy regulations.

Display grows despite smaller market share

Overall display revenues hit $74.3 billion in 2024. Display is also showing stronger YoY growth this year at 12.4% — three times the growth in 2023 (4%). The revenue increase is happening despite display’s declining market share: Last year, it had 28.7% of advertising, down from 31.5% in 2020. It is unclear whether revenue will continue to grow or stabilize around the current level.

Dig deeper: 94% of advertisers concerned tariffs will lead to cut in ad spending

AI optimization fuels programmatic increase

Programmatic advertising revenue increased by $20.6 billion since 2023 to $134.8 billion in 2024. The 18% increase is driven by automated, AI-driven ad placements that enable real-time optimization and data-driven targeting. Some 61% of its revenues come from a programmatic marketplace where real-time bidding (RTB) occurs, and any advertiser or publisher can participate. The remaining 39% was direct via private marketplace, preferred deals or automated guaranteed revenues. That split is nearly identical to 2023’s 63% RTB and 37% direct deals, indicating a stable balance between open programmatic bidding and direct-sold inventory.

Podcasting skyrockets in digital audio

Digital audio, including podcasting, has continued to grow, earning $7.6 billion in revenue with an 8.5% YoY growth — a slowdown from 2023’s 18.9% and 2022’s 20.9%. Last year’s growth was mainly because podcasting revenue surged to 26.4% from 5.5% in 2023.

However, audio consumption continues to increase, and IAB data suggests continued expansion and growth in digital audio advertising in 2025 as brands and platforms invest more in podcasts, streaming music and voice-based advertising.

Looking ahead

The report shows brands are rethinking their ad strategies and moving to cross-platform approaches, including retail media. Advertisers are now dynamically shifting budgets based on what’s working best, rather than sticking to set plans. Many are expanding to platforms like Instagram, YouTube, and newer networks for broader reach and flexibility. Decentralized social media and subscription models are also gaining traction for better control.

The future of ads is in connected systems of content, commerce and customer data, all driven by AI. Brands using AI to link what people see with chances to buy – and measuring real results – will be the leaders in a performance-focused, privacy-aware digital world.

Dig deeper: Despite challenges, marketers say retail media is the channel of choice

The post IAB report reveals digital ad growth and marketers ready for economic turmoil appeared first on MarTech.